There are a bunch of blog posts and videos about growing your social media following and how to slay, but hardly anything about growing your bank accounts. Wow – that’s a bold and, lowkey, inaccurate statement so let me correct myself! There are tons of financial resources out there in the world, but not a lot of “millennial-friendly” (i.e., realistic, digestible) resources to assist with money management. So, I want to start a Money Moves series, where I share some of the tips and tricks I learned over the years to get my money right and maximize my financial gains.

There are a bunch of blog posts and videos about growing your social media following and how to slay, but hardly anything about growing your bank accounts. Wow – that’s a bold and, lowkey, inaccurate statement so let me correct myself! There are tons of financial resources out there in the world, but not a lot of “millennial-friendly” (i.e., realistic, digestible) resources to assist with money management. So, I want to start a Money Moves series, where I share some of the tips and tricks I learned over the years to get my money right and maximize my financial gains.

[DISCLAIMER: I am not a financial advisor or wizard. I am just an ordinary girl who’s learned a lot about making, saving, and spending money over these past few years.]

I want to start my Money Moves series with the eight things I do to save money fast. I used this method to help me buy multiple cars within a year, fund a few vacations, cover a few weddings, handle costly emergencies, and more.

Let’s jump into this list of things I do to SAVE SAVE SAVE!

Tip No. 1: GET REAL ABOUT YOUR FINANCIAL SITUATION

First thing first, assess your spending habits! Evaluate how much income you bring in monthly, how much money you bring in after paying your bills and your student loans, what your spending habits are (are you a budget nerd or impulsive shopper), and where you want to be financially in the long run.

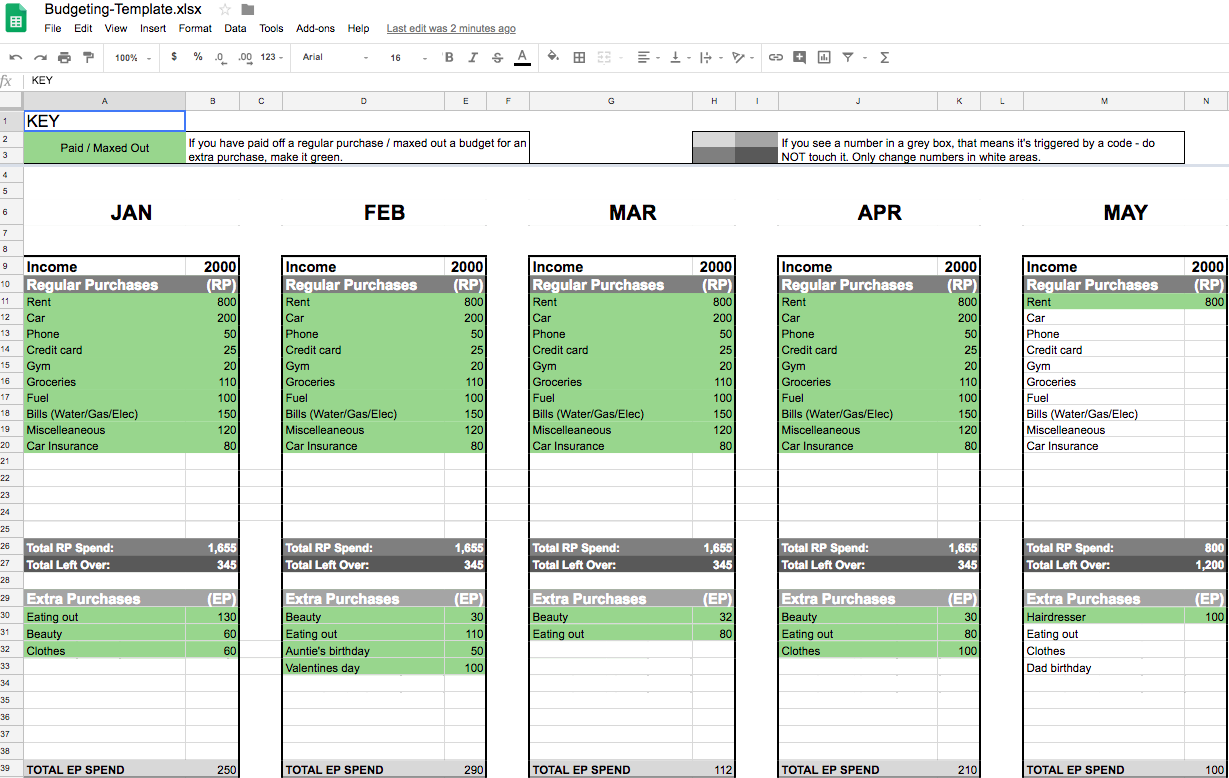

Create a budget to help assess your financial situation. Toni Tone, a British social media influencer, created a bomb budgeting template that’s perfect for seeing what your money looks like on a monthly basis. It’s intuitive and easy to use. Simply plug your income into the “Income” section at the top of the sheet and, then, fill out your expenses below. Using this spreadsheet will allow you to see your monthly spending habits and out how much money you have to roll over into your savings at the end of the month. Click here to check out this phenomenal spreadsheet. It will upgrade your life!

Tip No. 2: THE MODIFIED 50-30-20 RULE (i.e 50-40-10 RULE)

The traditional breakdown of this budgeting rule is:

- 50% of your income should go to living expenses and essentials, like rent, utilities, food, etc.

- 30% of your income should go to flexible spending, like traveling, hanging with friends, etc.

- 20% of your income should go towards financial goals, like savings, investing, and paying off debt.

When you are trying to save aggressively, I like using this iteration of the method:

- 50% – living expenses, which includes monthly debt payments.

- 40% – savings, consider getting a Money Market Account (MMA) or, even, a Certificate of Deposit (CD) if you don’t mind your money being locked down for a definite period.

- 10% – flexible spending

I know this sounds crazy, but cutting back on flexible spending means you won’t be squandering money, which translates to more money in your savings account. I recognize money could be tight – i.e., you are just making enough to survive or just making ends meet – making it hard to save. But, it’s critical to see your finances on paper and implement an aggressive saving schedule because it will force you to re-assess your financial needs. It will encourage you to get creative about finding new streams of income or motivate you to apply for those higher paying jobs you think you are unqualified for.

I know this sounds crazy, but cutting back on flexible spending means you won’t be squandering money, which translates to more money in your savings account. I recognize money could be tight – i.e., you are just making enough to survive or just making ends meet – making it hard to save. But, it’s critical to see your finances on paper and implement an aggressive saving schedule because it will force you to re-assess your financial needs. It will encourage you to get creative about finding new streams of income or motivate you to apply for those higher paying jobs you think you are unqualified for.

Tip No. 3: CUT BACK ON UNNECESSARY SPENDING

Saving money means cutting back on unnecessary spending. When I want to save money, I usually cut back on the expensive nail sets (and pull out my Essie nail polishes), happy hours, eating out, Uber rides, and so forth. You’ll be surprised by the amount of money you can save by cutting out a few extracurricular activities and unnecessary spending. So, please don’t do what Wayne is doing here. I know it’s tempting when you get that check, but it will hurt your heart and pockets in the long run!

Tip No. 4: BROWN BAG

I save a lot of money brown bagging. Brown bagging means bringing your breakfast, lunch, or dinner to work or school. At my previous job, I would spend anywhere between $100 to $200 per week on food. Yes, on FOOD! That is $400 to $800 per month on FOOD alone. That is INSANE, right?!? Thankfully, I got smart and killed that lousy habit after two weeks of buying my breakfast and lunch at work. These days, I brown bag every day except for when I have a networking lunch. BONUS: brown bagging allows you to take control over what you eat – making it easy to preserve your sexy and remain (or become) SNATCHED!

Tip No. 5: USE ONLINE SAVINGS APPS AND TOOLS

Ebates, Ibotta, and Honey are phenomenal savings and cashback tools, so take advantage of them. Promo codes and coupons also come in handy when you go shopping online or in-store, so search for them and use them. Savings and cash back from these tools add up, so DON’T SLEEP ON THEM!

Tip No. 6: SAVE ALL YOUR UNEXPECTED (SURPRISE) MONEY

Deposit any unexpected extra money (i.e., tax refunds, Venmo payments from doing your friend’s hair or makeup, the money you found in your pockets or under the couch) you earn into your savings account immediately. The longer it sits in your wallet or purse, the more likely you’ll spend it.

Tip No. 7: LEAVE ALL YOUR CARDS AT HOME

My latest rule is the “CARRY CASH AND ONE CARD RULE.” This rule requires that you only spend the cash you withdraw for your weekly allowance, except when there is an emergency* at which time you can use your card. It’s simple.

- Set a weekly allowance based on your budget and the 50-40-10 Rule;

- Withdraw that money at the beginning of the week and plan how you are going to spend it throughout the week;

- Spending accordingly; and

- Roll over whatever you don’t use

The goal is to avoid spending beyond your means. Hello, discipline! At the end of the week, throw whatever you have into your savings account, and start all over again.

*Please Note: It’s up to you to define what constitutes an emergency. For me, emergencies are car-related or health-related situations that require money. Seeing a cute dress while window shopping is NOT an emergency. However, I will admit once or twice I used this exception to buy a unique item I was planning to purchase, but happened to find on sale for a once-in-a-lifetime type of price. My advice is to be reasonable and carve out hard exceptions for yourself.

Tip No. 8: GIFT CARDS AND CASH

For your birthdays and special occasions, express a preference for gift cards to your favorite stores, visa pre-paid cards, or money. Don’t outright demand these things because that feels a bit tacky. However, if asked, request them. That way, you have money or cards to cover your day to day needs and desires. I love getting Target gift cards because that’s where I purchase a lot of my self-care products, household products, and, sometimes, snacks. I find that gift cards that allow you to shop multiple categories at the same store are best!

These are my top saving tips. Let me know which ones you are going to try, which ones don’t you like, and if you want more information on any of these tips.

Until next time, xoxo!